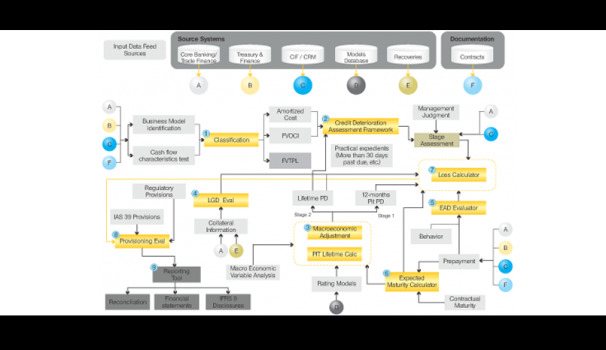

Core expertise in building, validating and monitoring models to address requirements of Expected Credit Loss (ECL) and lifetimes estimates under the IFRS 9 regulation

Aptivaa's comprehensive understanding of the IFRS 9 accounting principles and intensive experience in its end to end implementation across the globe makes it a frontrunner to help the enterprises in implementing, validating and updating their IFRS 9 frameworks.

-1594096185-1_crop.png)

The advent of IFRS 9 across the Banking industry has led to the emergence of various challenges for risk managers. Given the current practices with respect to incorporation of macroeconomic... Read More

Aptivaa helped the client to estimate the IFRS 9 expected credit loss and compare it with the existing expected loss numbers (IAS 39) for all the assets classes... Read More

Introduction The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU), Financial Instruments Credit Losses in June, 2016. This ASU 2016-13 introduces a new. Read More

Aptivaa has been a key representative speaker across panels of various risk events held recently such as the PRMIA Qatar chapter event, a Workshop on IFRS 9 organized by FIS for.. Read More

During the IFRS 9 Implementation & impact assessment phase majority of the banks anticipated a negative impact on their balance sheets and the same was evident in the December 2017 financial disclo... Read More

The average provision coverage ratio has increased by 28% across the four countries. The increase has been highest for Qatar and Kingdom of Saudi Arabia. The impact of ECL for most of the Banks in UAE Read More

Are you still clinging on to your rusty legacy technology that`s gracefully aging towards obsolescence? Perhaps you are still running important applications on legacy databases.. Read More

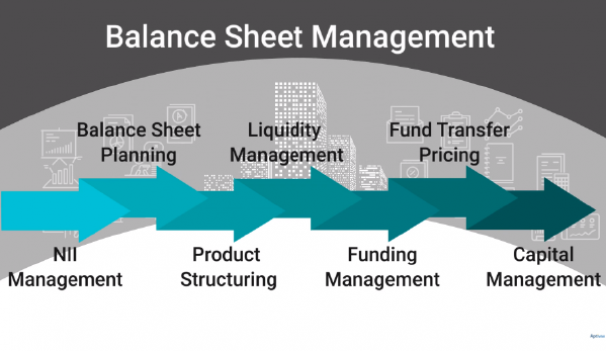

Banks are scrambling to meet with IFRS 9 guidelines and are setting down on the path to implement various ECL estimation methodologies and models. But a topic that hasn't been given.. Read More

As the race against time to comply with IFRS 9 guidelines begins, several software solutions are being bandied about as a quick fix solution for automating the entire impairment modelling process.. Read More

The new standard on financial instruments accounting - IFRS 9 has significantly transformed banks'existing impairment assessment to address concerns about "too little, too late" provisioning for.. Read More

Under IFRS9 Framework, impairment assessment requires computation of Expected Credit Loss (ECL) that reflects a probability-weighted outcome, the time value of money and the best available Read More

In our earlier blog, we discussed PD terminology and PD calibration approaches as applicable to the IFRS 9 framework. IFRS 9 has mandated computation of Impairment Losses, approach.. Read More

Under IFRS 9, Expected Credit Loss (ECL) for financial instruments should be an unbiased and probability weighted amount, which is determined by evaluating a range of possible outcomes. To meet this.. Read More

Financial Institutions across the globe are preparing themselves to meet the January 2018 deadline for compliance with IFRS 9. One of the most critical aspects of the new standard is the.. Read More

In our second post building blocks of Impairment Modeling, we had highlighted that IFRS 9 uses a three stage model for measurement of ECL, and one of the major challenges of. Read More

Subscribe to our insights to get them delivered directly to your inbox