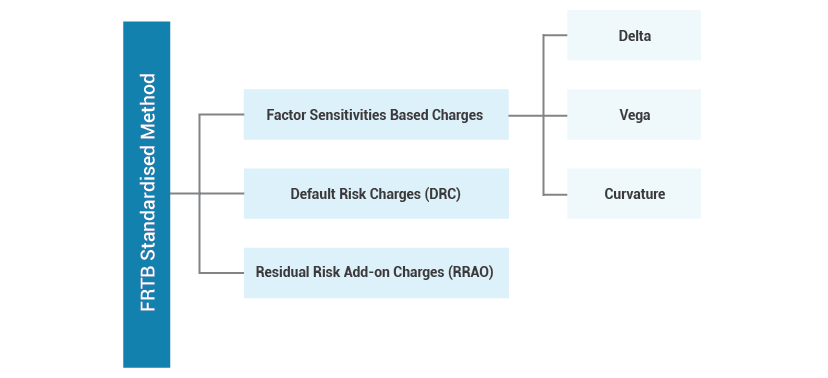

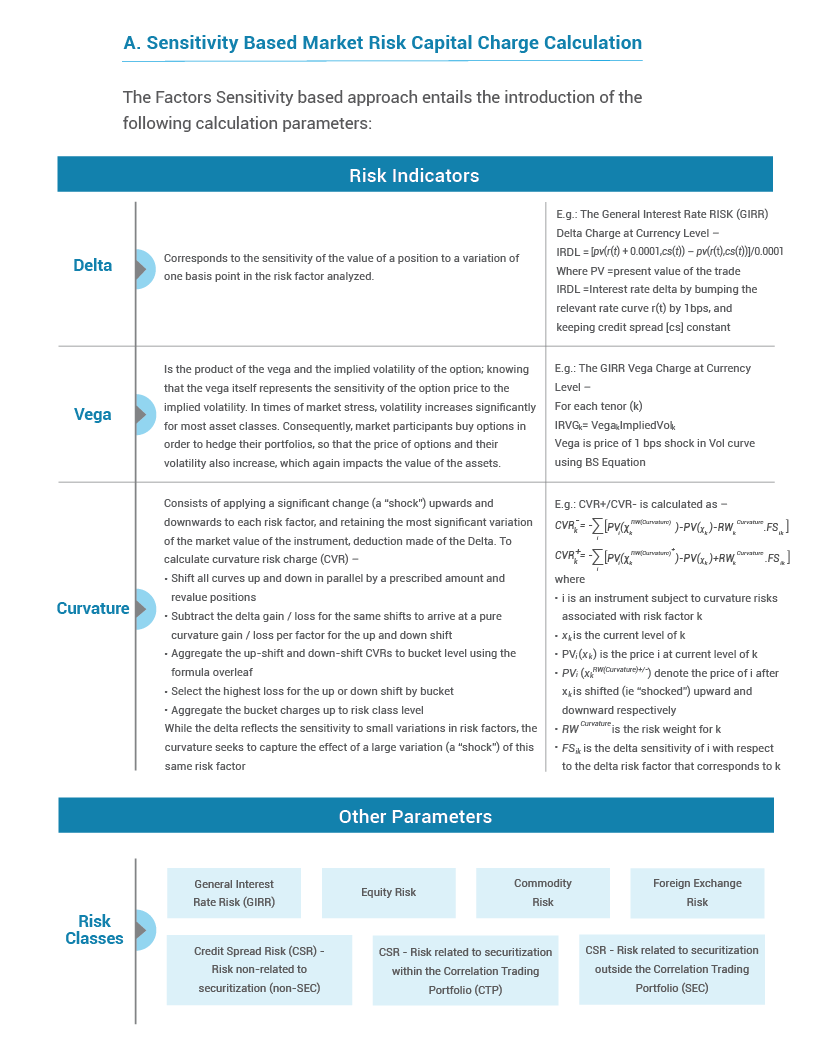

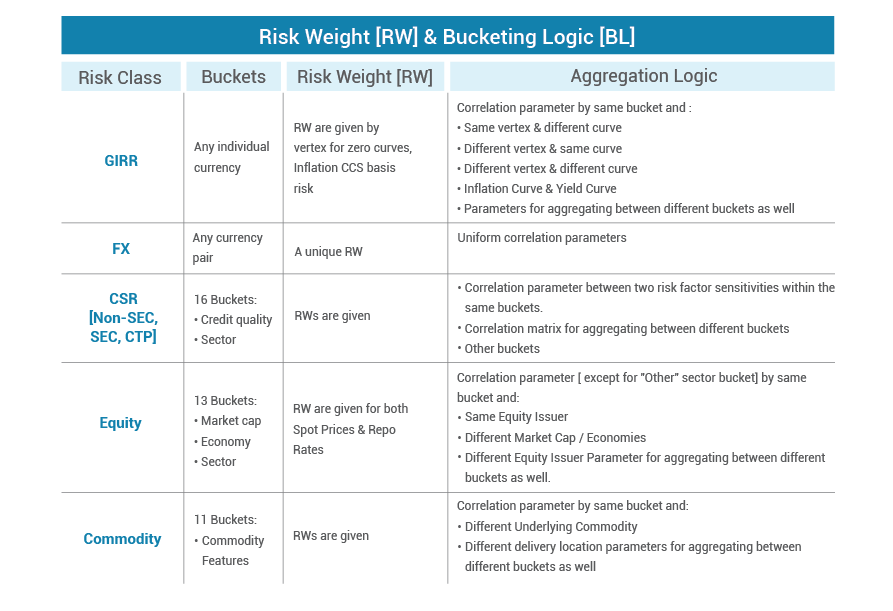

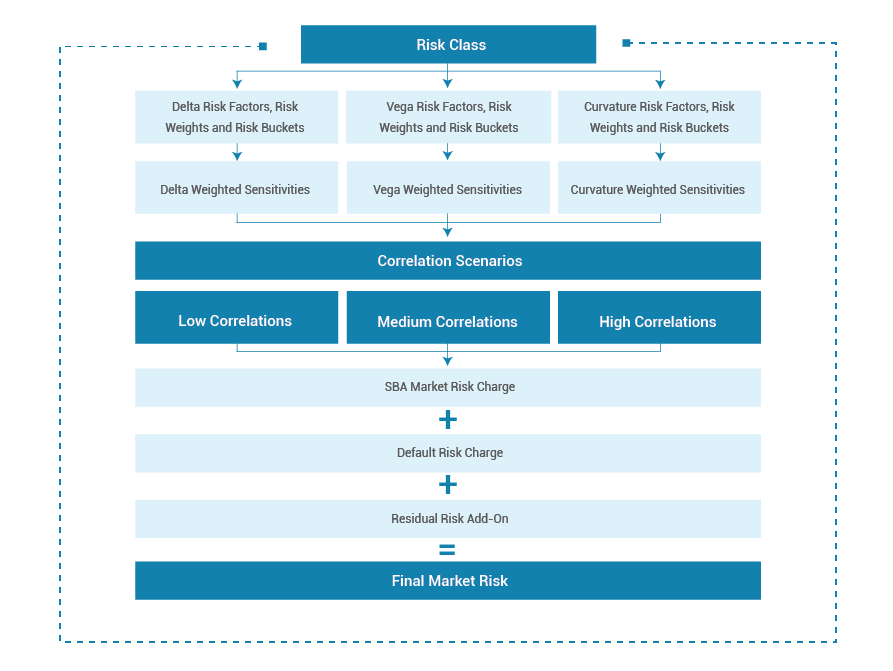

The standardised approach (SA) market risk capital charge calculation method is to come into effect from 2023 onwards. The calculation of market risk capital charge using the standardised method consists of determining a capital charge per risk class using the Sensitivities Based Approach (SBA) and aggregating them to determine the overall capital charge for market risk. To this are added the charge for the risk of default, as well as the additional charge for the residual risk to arrive at the minimum capital requirement as per the standardised approach.

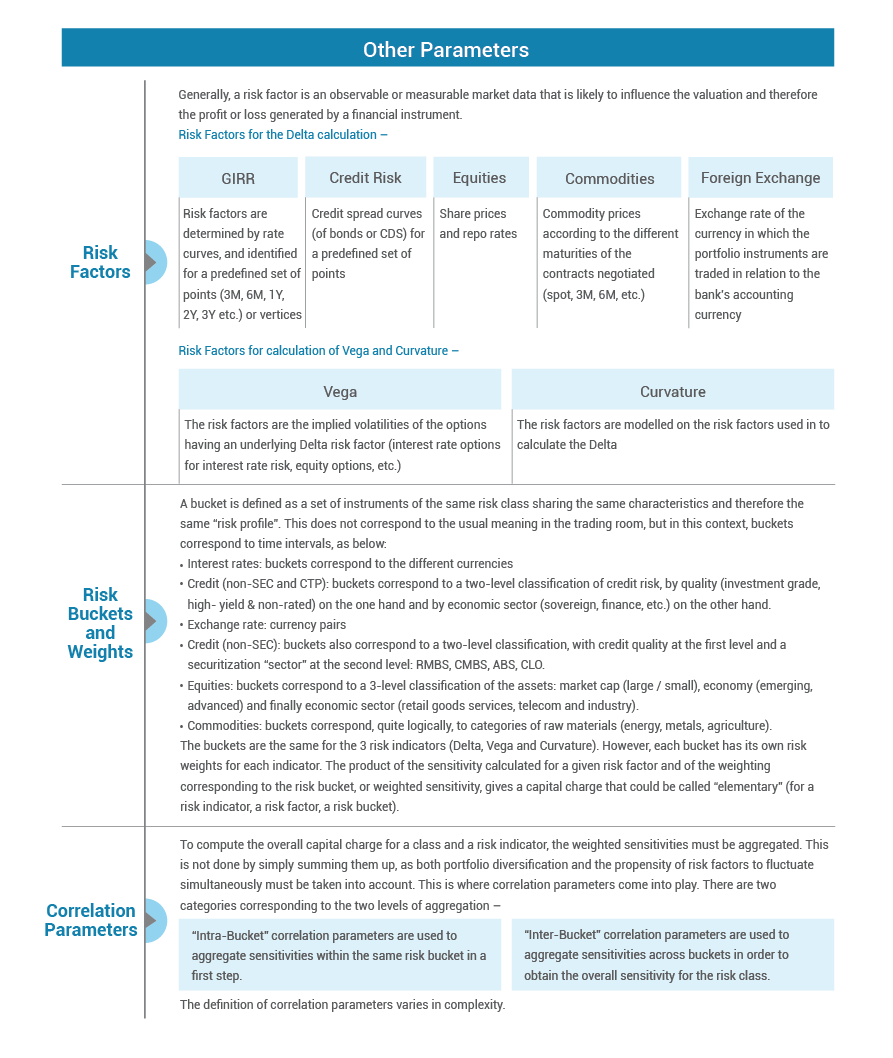

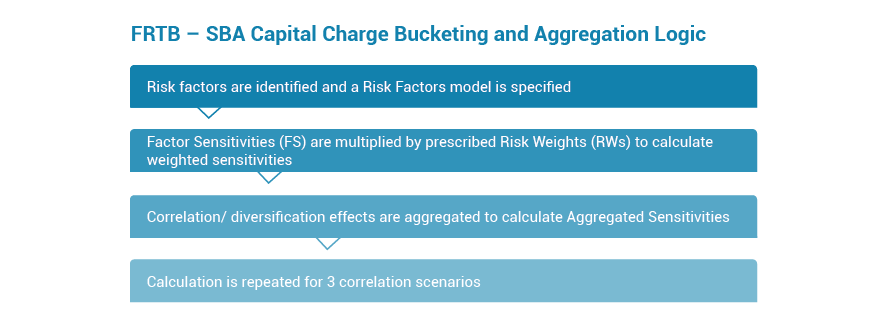

Identify Risk Factors

Calculate Weighted Sensitivities

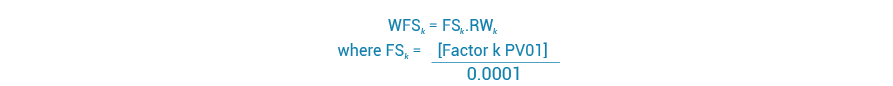

Each net sensitivity is then assigned the risk weight provided in the documentation for the relevant risk factor and risk bucket to give the weighted sensitivity.

For example, Risk Weighted Factors Sensitivities for GIRR Delta charge at currency level for each Tenor [k] will be calculated as

We can think of dividing PV01 by 0.0001 as converting a sensitivity into a ‘Notional-Equivalent’ to which a % Risk Weight is applied. Or we can think of the % RW divided by 0.001 as a bps scenario that is applied to a PV01.

Aggregate Sensitivities

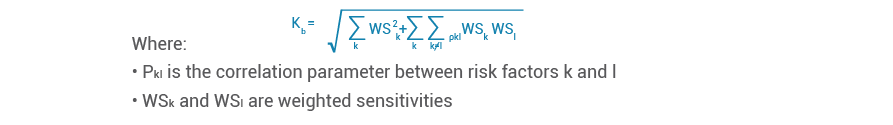

a) By Bucket

Weighted sensitivities by risk bucket must then be aggregated. For Delta and Vega, the formula for calculating the capital charge for bucket b is as follows:

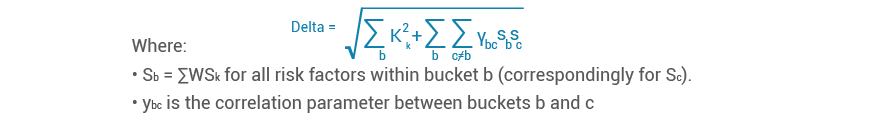

b) By Risk Class

The aggregation by risk class is done in a similar way using the results of the previous step and the correlation parameters between buckets within the same risk class:

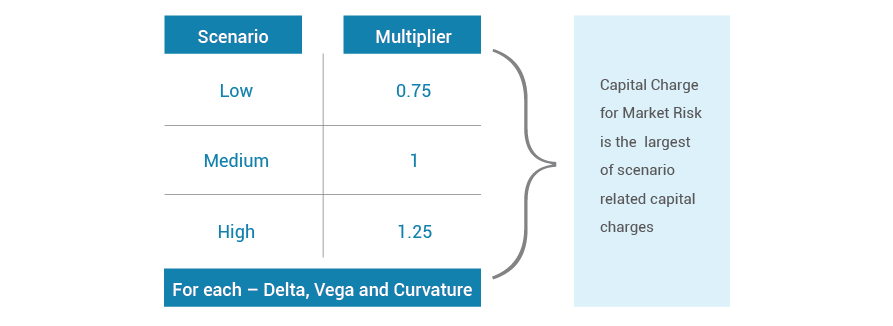

Scenarios

This dual aggregation process must be carried out 3 times per risk class and indicator, with three different correlation scenarios: low, medium and high. For each indicator, the correlation scenario with the highest end result (Delta + Vega + Curvature, for all risk classes) will be retained.

Using 3 scenarios makes it possible to take into account the fact that in times of market stress, correlations between risk factors may increase or decrease.

The total capital charge is equal to the sum of Delta, Vega and Curvature charges. The three capital charges are calculated for each of the three correlation scenarios, and the highest one is retained as the capital charge for market risk.

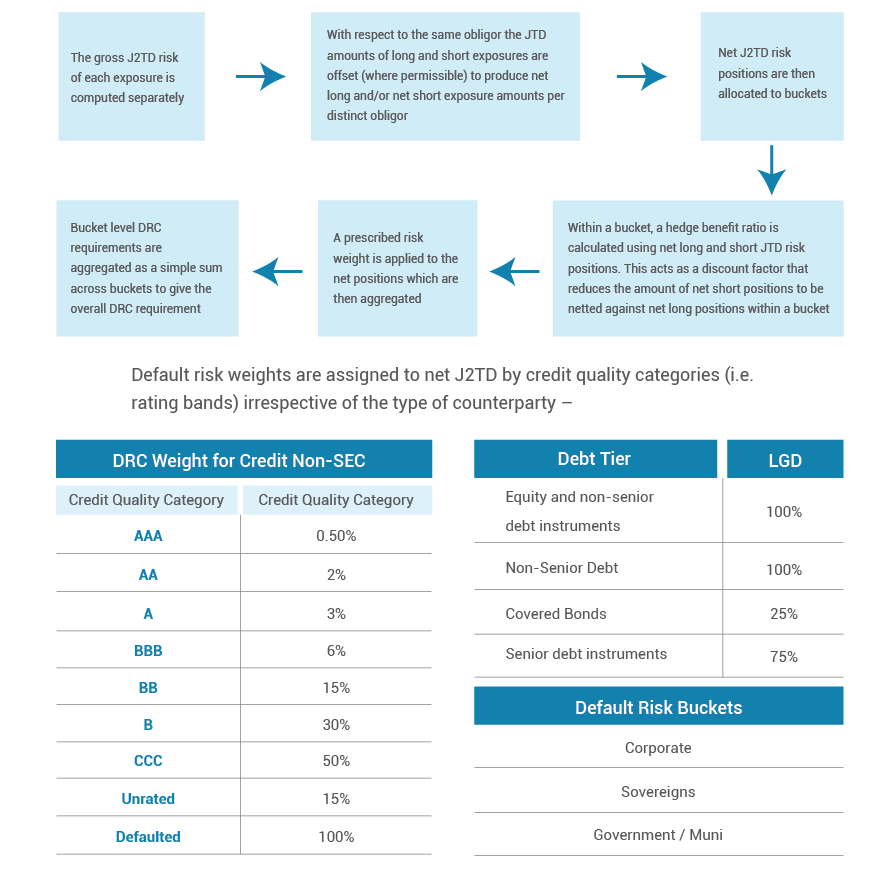

B. Default Risk Capital Charge Calculation

The default risk capital (DRC) requirement is intended to capture jump-to-default (J2TD) risk that may not be captured by credit spread shocks under the sensitivities-based method. DRC requirements provide some limited hedging recognition and banking book like treatment.

Net jump-to-default risk positions (Net JTD)

Exposures to the same obligator may be offset as follows:

Net jump-to-default risk positions (Net JTD)

The following step-by-step DRC Calculation approach must be followed for each risk class subject to default risk –

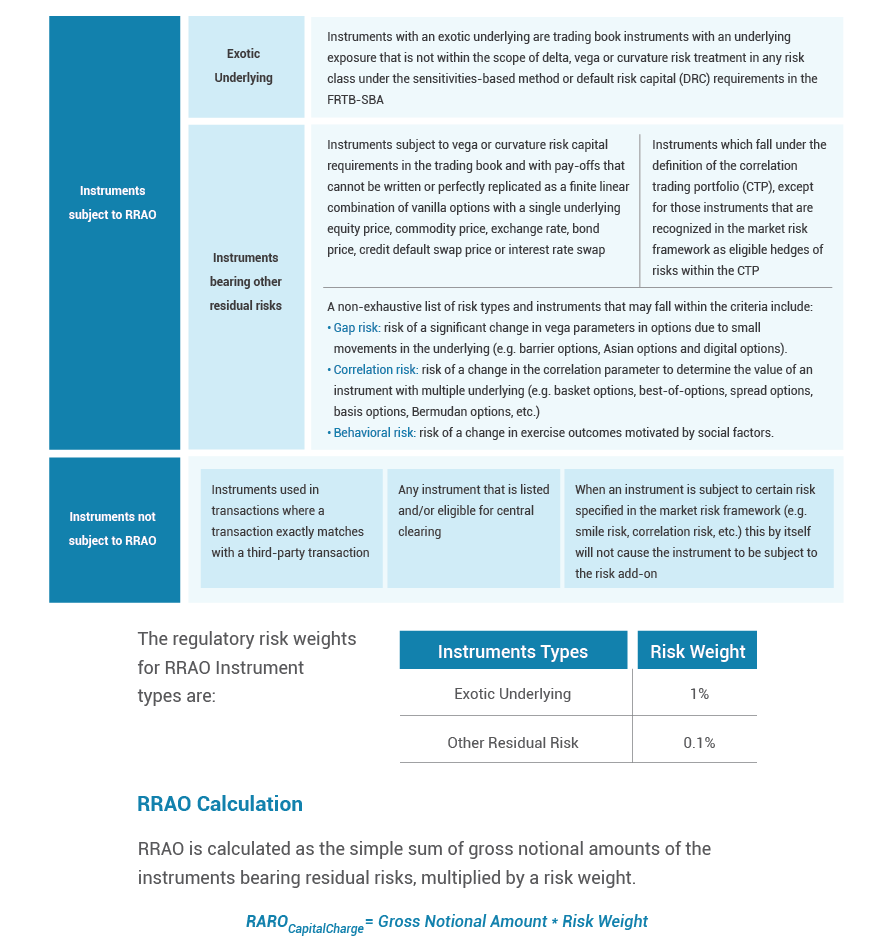

C. Residual Risk Add-On (RRAO) Capital Charge Calculation

The Residual risk add-on (RRAO) is to be calculated for all instruments bearing residual risk separately in addition to other components of the capital requirement under the FRTB Standardised Approach.

Conclusion

The institutions are faced with a multitude of adjustments and calibrations in their methodology of capital charge computation for market risk, however the Standarised Approach provides a credible alternative for trading desks to operate under a capital regime that is conservative, but not totally punitive. There is a complexity to factor for the banks considering to adopt the Standardised Approach capital charge calculation and looking to leverage their existing sensitivity-based VaR model, due to the difference between the existing sensitivity calculations and the prescribed FRTB formula. Unless it can be shown that the discrepancies between the 2 sets of formulae are minor, some analytical duplication might have to be undertaken, with a set of calculations for FRTB and another set for internal risk management.

Don't miss this roundup of our newest and most distinctive insights

Subscribe to our insights to get them delivered directly to your inbox