As markets realign and customer behaviour shifts post-pandemic, banks need to relook at their pricing practices to stay competitive and ensure risks are getting accurately priced.

Fund Transfer Pricing (FTP) is a key component of the mechanism used to price all assets and liability products offered by a financial institution. FTP informs banks over a range of critical areas such as pricing, risk transfer, performance management and strategic decision making, to name a few. FTP has gained in prominence thanks to the global financial crisis that led to a plethora of new regulations, where FTP has become the common and hidden strand. All the regulations either directly or indirectly highlight the aspect of accurately pricing all risks on the balance sheet. This article provides an introduction to FTP, the need to relook at the extant practices and the various implementation approaches that can be adopted by the banks. It also captures key highlights of recent regulatory changes and how banks can ensure alignment of their internal pricing mechanisms with the regulatory expectations and tectonic shifts in the market post-pandemic while still serving the strategic objectives of the organisation.

What is FTP?

Banks are in the business of intermediation, providing funding to critical areas of the economy while absorbing liquidity in areas where it is in excess. This intermediation is asymmetric in that Banks tend to borrow short and lend long, and interest income is a major source of revenue for the banks. However, if the transformation process is not controlled tightly, the risks can quickly accumulate and spill over to the real economy, resulting in significant disruptions, an example of which is the Global Financial Crisis.

The primary reason cited as the root cause of the crisis is the excessive funding of long-term subprime mortgages using cheap short-term wholesale funding.

To start with a basic example, a manufacturing firm should factor in all its costs (direct and indirect) in pricing its products and add a margin to remain profitable. In the same vein, a bank needs to price all its direct and indirect costs in pricing its products and services, that is, its asset and deposit products. While there are some costs which are easy to identify and price-in, (like staff cost, regulatory expenses, operational expenses, etc.) there are components which are difficult to quantify in a direct way. These components pertain to risks that arise on account of maturity transformation i.e. borrowing short from deposits and lending it long to borrowers. This transformation includes interest component, liquidity as well as credit component. If the fees and rates charged on the products don’t effectively cover for the losses on account of these risks, it will erode the value of the organization eventually and put its survival in jeopardy. Summarized below are the key transformations performed by banks:

CREDIT TRANSFORMATION

Credit transformation is the main transformation whereby banks issue deposits to their clients or depositors against their own credit profile to raise money and invest the proceeds in relatively riskier assets like mortgages, project finance and others. Banks do invest in high quality assets such as government securities, treasury bills and retain a portion of the funds in cash. However, these constitute a relatively small portion of their total balance sheet. Credit transformation exposes the bank to credit risk.

MATURITY TRANSFORMATION

Banks raise short-term funds and invest those proceeds in long-term securities or assets, thereby performing maturity transformation of funds received to funds disbursed. It is not only that the funds are moving from one business unit (liability generation unit) to another business unit (asset creation unit), but the timing mismatch is also active in the transaction through maturity mismatch between the tenor of deposit and the tenor of the asset. Maturity transformation exposes the bank to interest rate risk.

LIQUIDITY TRANSFORMATION

Liquidity transformation is the least understood aspect and often either not priced or insufficiently priced in by banks. Banks issue liquid securities in the form of liabilities (time deposits, checking accounts and savings accounts) on which the customers have an embedded option to redeem prior to their maturity with no or little penalty, if any. On the other hand, banks cannot expect the same level of payment behaviour (payment at demand) from their asset portfolio. Liquidity transformation exposes the bank to liquidity risk.

Credit risk is relatively the easiest and accurately identified risk by most banks and is priced in by charging a credit risk spread either based on the external rating of the facility (client) or based on internal assessment or a combination of both. Interest rate risk and liquidity risk are difficult to identify and accordingly price in. FTP deals mainly with the identification of interest rate risk and liquidity risk and segregating credit risk from these two risks. As FTP deals with identification of risks, the corollary of this aspect is that FTP can also be utilised in the profitability measurement and in the overall strategic objectives of the bank. FTP can now be defined as,

A methodology through which banks price the funds that they transfer from one business unit to another.

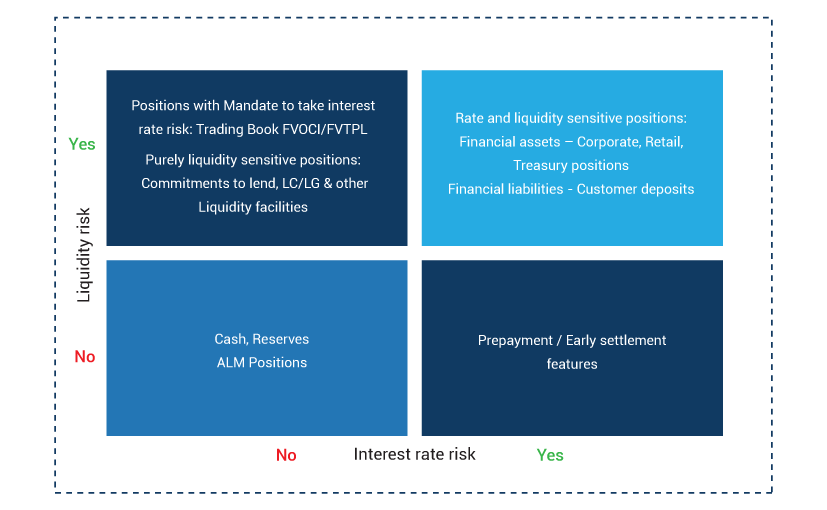

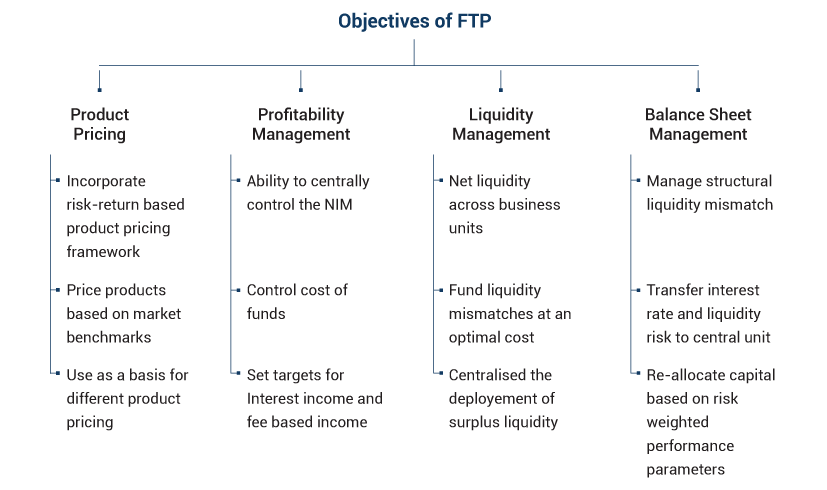

FTP provides a basis for the exchange of funds between different business units of a bank. It is an internal allocation and measurement mechanism for pricing of incremental loans/investments /deposits as well as for determining the profit contribution of various lending and borrowing units of a bank. It is a critical component of the profitability measurement process, as it allocates the major component of earnings of a bank, that is the Net Interest Margin (NIM) to different business lines and product portfolios. It is also a management decision tool and is extremely useful to identify the areas of strength and weakness in terms of product profitability, that is, which are the most profitable products and which are the least profitable products/business lines. FTP is a management concept for allocating true costs of funds to business. Illustrated below is a matrix which classifies typical products on a bank's balance sheet by the applicability of interest rate and liquidity risks.

Key Roles of FTP Framework

The balance sheet profile of banks is becoming more complex with wide varieties of assets and liabilities in terms of

The interest rate itself is becoming more volatile and with increasing linking of international markets the fluctuations in interest rates and currency is now dependent not only on the domestic economy but also on the international activities. The volatility in interest rates affect both the current earnings and the net-worth of the bank.

However, in a bank there are a large number of sources of funds (depositors, bank’s debt holders) and equally large number of uses of funds (mortgages, personal loans, investments, etc.). It is impossible to achieve a one-to-one match between the liabilities and assets of a bank. A central funding unit, generally the Treasury unit of the bank, absorbs the sources of funds, provides for uses of funds and manages any mismatches through market operations (money markets, security issuances, liquid investments). FTP is a key element of this process.

Without a proper FTP framework, a transaction that is profitable at the time of initiation might lose its sheen with changes in interest rates. Proper FTP framework (matched-maturity approach) ensures that such type of transactions are not entered in the first place and the profitability of the product remain constant throughout the life of the product, given its credit profile remains same. A proper FTP immunizes the business lines with the variability in the interest rate and liquidity in the market on the profitability of the transaction, making business only responsible for managing the credit risk that is its core area.

From a profitability perspective, interest income and expenses constitute the largest component of any bank’s profits; the former is received on loans and investments while the latter is paid on deposits. Without FTP framework it would appear that all deposits generate only costs whereas in fact they are the source of funding necessary to create loans and investments. As a consequence, business units that only raise deposits without giving loans would be deemed unprofitable. It is important for the bank to measure the contribution of every unit, product and business to facilitate performance evaluation and future strategy. FTP sets an internal price that allows estimating the cost of financing and assigning it to the users of funds. It has been observed at banks that many a times, deposit raising units are the most profitable ones.

Evolution of FTP Approaches

There are multiple approaches of FTP that can be adopted by a bank, depending on the variety and complexities of assets and liabilities and the level of granularity required for pricing and tracking the profitability of various products/business lines. The basic idea is to compute a rate curve and then apply the rate curve in a consistent manner. All the various methodologies of FTP are based on varying levels of sophistication of computing and application of this rate curve.

In terms of scope and coverage of FTP the need of the day is into link it closely to the market through use of market benchmarks for pricing and incorporate liquidity as a key aspect.

There are three main FTP approaches and all the others can be clubbed with either one of them with some level of variations.

All these approaches have their own benefits and weaknesses. The bank has to find its sweet spot based on the complexity and variety of products offered, complexity of operations and level of sophistication needed to achieve its desired ALM profile and the overall strategic objective goals.

Single pool approach

This method uses a uniform funds transfer rate for both assets and liabilities and hence does not consider factors like maturity transformation and liquidity risk.

The single pool approach is best suited for small banks that have stable but undiversified sources of funds and whose primary financing for loans is from customer deposits.

However, there is no separation of interest rate risk from credit risk, and liquidity risk is completely ignored. The measurement of managerial results is not fair since prices are not assigned to transactions based on their risk characteristics.

Multiple pool approach

Under the Multiple Pool approach, FTP assets and liabilities are classified into different pools using some criteria. Such criteria may include factors such as maturity, the embedded optionality, credit rating of the portfolio, seasoning of the portfolio and so on. The pool criteria determines the transfer rate assigned to each pool, for example, a long maturity pool is assigned a long-term rate. The repricing term and original maturity are the major criteria for pooling assets and liabilities.

Under this method, every individual pool covers only one part of the maturity spectrum and the number of pools are dependent on the structure of the balance sheet. Multiple pool approach achieves a higher level of sophistication than single pool method. It enables accurate profitability calculation of floating rate products and fairly correct for fixed rate pools based on current market rates. It incorporates time structure of assets and liabilities to some extent while allowing adjustments.

However, in this approach too, profitability of products is influenced by changes in market interest rates. And interest rate risk is still not separated from credit risk and fails to assess the true cost of liquidity.

Matched maturity approach

The Matched-Maturity approach FTP is the most sophisticated approach. In this approach the prices are allocated to individual transactions as opposed to pools. By allocating prices to individual transactions separately, the transfer rates accurately reflect the interest rates on those transactions meaning that the end result is more accurate than in the multiple pool approach. The matched-maturity approach takes into consideration the unique features of funds at the cash flow level and is therefore the most preferred FTP approach. This method prices each transaction by way of reference to a cost for the specific term involved.

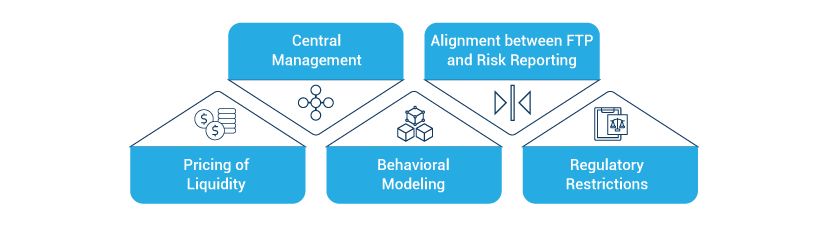

A few of the key decision points typically considered by ALCO while defining an FTP framework are presented below.

The starting point is a yield curve related to the bank’s funding costs. For banks that are active borrows in the capital markets, this curve can be constructed from yields on the bank’s traded senior unsecured debt. If there are insufficient data points, a derived curve can be used such as swap rate plus a credit spread corresponding to the rating of the bank. A deposit or loan now has a base price determined by reference to the appropriate maturity on this curve.

This approach recognises that the costs and inherent liquidity risks are related to the maturities of assets and liabilities, and therefore allows different rates to be assigned to products with different maturities and liquidity characteristics. It recognizes the importance of having changes in market conditions quickly and efficiently incorporated into the rate used to charge users and credit providers of funds, and therefore relies on the marginal cost of funds. It incentivizes the bank to eliminate costliest marginal funds so that the threshold for lending rates reduces.

The biggest advantage of matched maturity approach over the other two approaches is the separation of interest rate risk from credit risk. Every sales unit accounts for its corresponding credit risk – meaning that there is no unfair advantage or disadvantage of certain products or business lines over others as does happen when they are pooled together.

This approach also applies behavioural assumptions and the calculation of future cash flows is done at the transaction level based on the contractual features. The behavioural assumptions applied when calculating the transfer rate include

The matched-maturity approach makes it possible to use historical market rates to lock in the net spread and in doing so, the interest rate risk is effectively transferred from the concerned business unit to the funding centre. Similarly, since the matched maturity approach uses the historical market time series, it becomes easier to assess the effects of past pricing decisions.

Defining transfer-pricing curves accurately and frequently is critical for the success of the matched-maturity approach. It also requires robust systems to continuously determine market-based pricing for assets and liabilities based on defined market curves.

Regulatory Direction

The Global Financial Crisis highlighted many deficiencies in the liquidity risk management of banks and in the pricing of products. The sub-prime portfolio increased to such huge amounts because the actual riskiness of the transaction was not recognised or rather ignored. The portfolio was funded and even priced based on short-term relatively cheaper wholesale funding. If the pricing was done accurately to reflect the actual interest rate risk and the liquidity characteristics of the structure, size of the portfolio would never reach to that extent.

Subsequently, regulators emphasise on accurately pricing of the products and especially the liquidity risk that is indeed the most difficult one and till now generally ignored. Below are the specific guidance or recommendations on FTP by various regulatory bodies.

Principle 4 of BCBS publication “Principles for Sound Liquidity Risk Management and Supervision” published in 2008 states that,

“A bank should incorporate liquidity costs, benefits and risks in the internal pricing, performance measurement and new product approval process for all significant business activities (both on- and off-balance sheet), thereby aligning the risk-taking incentives of individual business lines with the liquidity risk exposures their activities create for the bank as a whole”.

Point 14 in Annex V of the amendments to the Capital Requirement Directive 2009 states that,

“Robust strategies, policies, processes and systems shall exist for the identification, measurement, management and monitoring of liquidity risk over an appropriate set of time horizons, including intra-day, so as to ensure that credit institutions maintain adequate levels of liquidity buffers. Those strategies, policies, processes and systems shall be tailored to business lines, currencies and entities and shall include adequate allocation mechanisms of liquidity cost, benefits and risks”

Committee of European Banking Supervisors published “Guidelines on Liquidity Cost Benefit Allocation” in 2010 and provide below five broad guidelines

Guideline 1

The liquidity cost benefit allocation mechanism is an important part of the whole liquidity management framework. As such, the mechanism should be consistent with the framework of governance, risk tolerance and the decision-making process.

Guideline 2

The liquidity cost benefit allocation mechanism should have a proper governance structure supporting it.

Guideline 3

The output from the allocation mechanism should be actively and properly used and appropriate to the business profiles of the institution.

Guideline 4

The scope of application of internal prices should be sufficiently comprehensive to cover all significant parts of assets, liabilities and off-balance sheet items regarding liquidity.

Guideline 5

The internal prices should be determined by robust methodologies, taking into account the various factors involved in liquidity risk.

Federal Reserve System publishes “Interagency Guidance of Funds Transfer Pricing Related to Funding and Contingent Liquidity Risks” in 2016, and provides four principles as under:

Principle 1

A firm should allocate FTP costs and benefits based on funding risk and contingent liquidity risk.

Principle 2

A firm should have a consistent and transparent FTP framework for identifying and allocating FTP costs and benefits on a timely basis and at a sufficiently granular level, commensurate with the firm’s size, complexity, business activities and overall risk profile.

Principle 3

A firm should have a robust governance structure for FTP, including the production of a report on FTP and oversight from a senior management group and central management function.

Principle 4

A firm should align business incentives with risk management and strategic objectives by incorporating FTP costs and benefits into product pricing, business metrics, and new product approval.

Additionally, the LCR and NSFR guidelines are also directly and indirectly penalizing the banks to run excessive maturity transformation with an intent if the maturity mismatch is reduced, it is imperative that banks will price long-term assets accordingly. As the long-term assets or less liquid assets are penalised through the requirement of higher Required Stable Funding factor in NSFR. Similarly, LCR provides higher weightage to retail stable funding as compared to wholesale funding.

All the regulatory guidance are emphasising on the proper allocation of costs and benefits of liquidity and in all the three approaches of FTP, Matched-maturity approach provides the best solution to the regulatory requirements/recommendations.

The case for moving to Matched maturity FTP

Accurate risk measurement is the most fundamental aspect of setting up a sound risk management framework that gives the correct view of risks to the management and thereby allows them to price it accordingly.

Aggregation of interest rate risk and liquidity risk in a central unit

If a branch gives a fixed rate loan of 3 years and funds it with a 1-year deposit of the same amount, the profitability of the branch over the next three years would be determined not just by the credit risk assumed on the loan, but also based on the movement of the interest rates over this period. Using the matched maturity FTP approach, the three-year asset of the branch would be funded by the central funding unit by a three-year notional liability and the one-year deposit of the branch would be matched with a notional one-year asset at the relevant transfer price for that maturity. This way the spread for the branch on its loan and its deposit would be locked-in and agnostic to the interest rate and liquidity risk. The central funding unit would, on an aggregate basis, manage the entire interest rate risk and the liquidity risk, and the branch would be insulated from it.

Drive behaviour of branches/ business units to meet the overall objectives of the bank

Depending upon the existing profile of the assets and liabilities of the bank and the future business strategy of the bank, the FTP can be so structured so as to align the individual goals with the organizational goals. For example, if a bank asset book is pre-dominantly mortgage loan of long maturities, and now the business strategy is to enter and build a portfolio of auto loans with three years maturity. A skilfully designed FTP framework will allow each entity/segment to focus on the goals assigned by the top management.

Provide guidance for risk based pricing of products at a transaction level

The pricing of the product should reflect the cost of funding and cost of credit risk (both in case of assets), the operations cost, cost of embedded options (e.g. prepayment option), cost of managing liquidity, cost of maintaining statutory reserves and interest rate risk. Matched-maturity FTP approach provides a consistent basis to arrive at this price at a transaction level. The price so arrived at serves as guidance to the business units, which they may suitably and consciously modify, if required, to take care of competition and customer relationship. In the absence of a well implemented FTP policy, product pricing may be devoid of the true cost to the bank and would get determined by external factors and hurt the bank in the long term. While competitive factors are indeed very important and the bank may not always be able to set the price for the customer, this approach would at least highlight which products are more profitable and which are relatively less so that the bank may decide where the volume focus should be.

Provide objective criteria for business unit/ product performance evaluation

Volume based evaluation of business performance provides an inaccurate picture because there is no direct correlation between volume of business done and profit earned. It is possible for a bank to increase its net profits even by shrinking its balance sheet size. If the balance sheet of a bank has increased but the profit has not, it could be because of multiple factors such as that incremental business was being done at a negative margin or there may be higher than expected credit losses from existing assets or operational costs may have increased. There are multiple drivers of the bank’s profitability and the extent of risk assumed by a bank impacts the current and future profits of a bank. Matched-maturity FTP framework provides a basis for risk attribution and return evaluation.

Don't miss this roundup of our newest and most distinctive insights

Subscribe to our insights to get them delivered directly to your inbox