Although the Fundamental Review of the Trading Book (FRTB), which is part of the Basel III revisions, has been in the making for several years, banks remain concerned about the demands on the quality and volume of Trade Data needed to determine the revised market risk capital charge. In this paper, we will discuss those market data challenges, along with potential means to address them. The data and computational challenges in implementing the Internal Measurement Approach (IMA) have been well documented, however, banks may find it equally difficult in sourcing and aggregating data for capital computation under the Standardised Approach (SA) as well. The calculation of market risk capital charge as per the Standardised Approach consists of determining a capital charge per risk class using the Sensitivities Based Approach (SBA) and aggregating them to determine the overall capital charge for market risk. To this are added the Default Risk Capital charge (DRC) for the risk of default, as well as the additional charge for the Residual Risk Add-On (RRAO) to arrive at the minimum capital requirement. This blog mainly focuses on the data challenges associated with the Sensitivity Based Approach (SBA) of the FRTB to calculate risk capital charge.

1. Factor Sensitivities [FS] Sourcing:

SBA under FRTB utilizes the factor sensitivities (FS) for capturing linear as well as non-linear risks, making it a departure from earlier standardized models. The use of FS as well as their calculation consistency are both prescribed by the rules for SA (as well as IMA).

However, requiring these calculations to be the same as those used for pricing models or instrument prices in the P&L statement or market risk management is a first. Thus calculations used for the valuation models for trading purposes by the front office are to be consistent with the sensitivities computation.

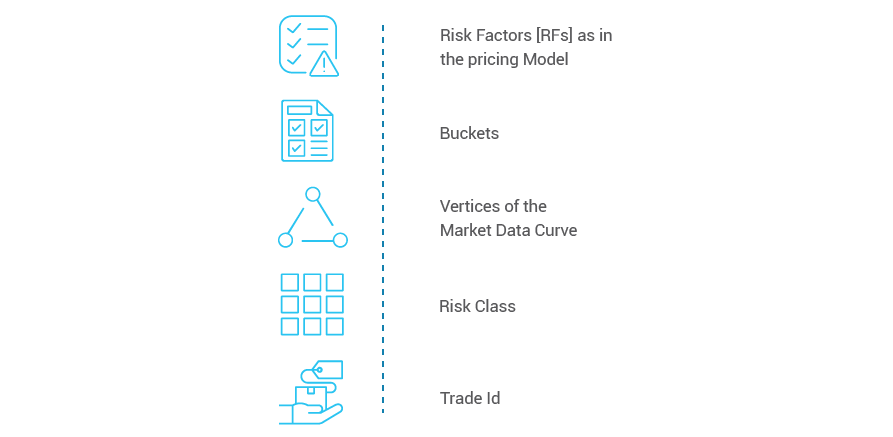

Also, granularity of risk factors as well as regulatory prescription are to be captured by the FS. The best practice would be to calculate FS once in the Front Office (FO) System as prescribed by FRTB, and store it in the golden database for downstream risk calculation, and organize and store FS data by the following attributes

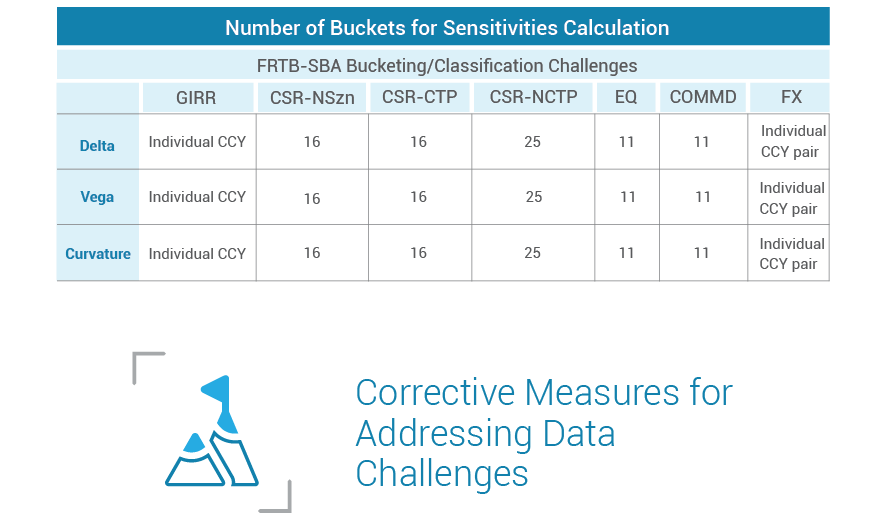

Sourcing and aggregating risk factors sensitivities [RFs] data for all risk classes along specified risk buckets and tenors is a critical requirement while performing FRTB-SBA capital assessments.

Documenting the FS data definition, and any gap with FO system with Market Risk System for FS reconciliation is the prime objective during capital assessment exercise.

2. Risk Factors [RFs] Mapping & Metadata Attribution:

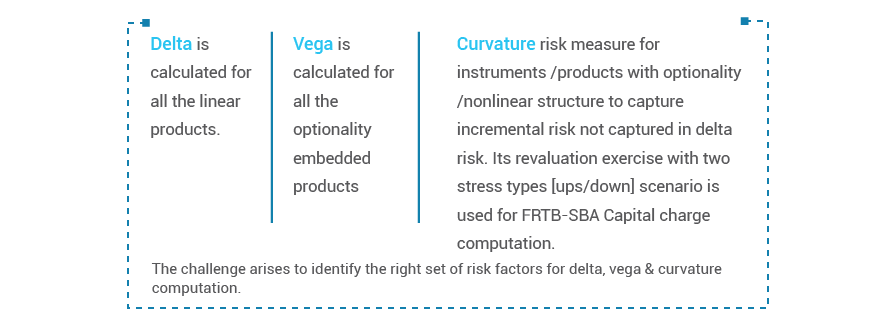

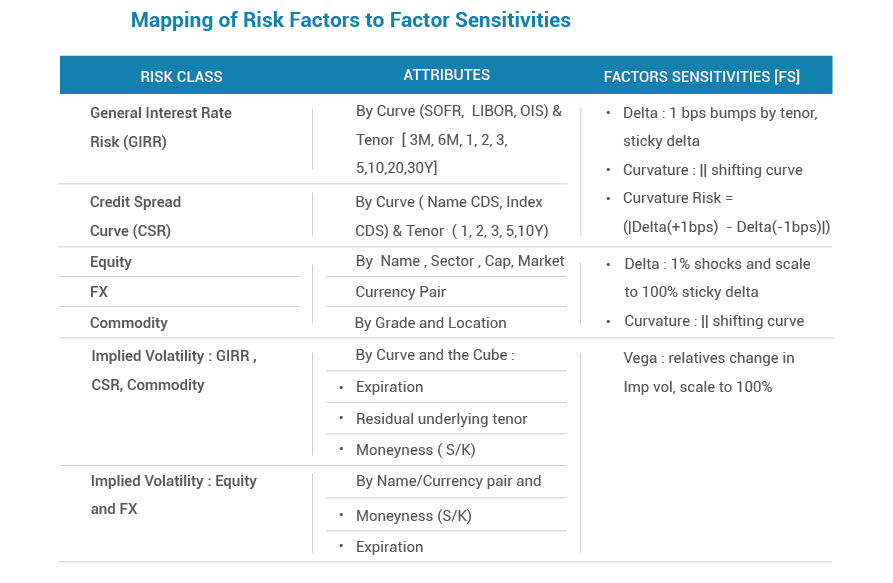

The RFs work as basic inputs into Bank Pricing & PnL calculation function. For example, SOFR term structure curve for Rates business, USD Vol Curve with Term Structure for Option products. Banks need to identify and define the set of RFs exposed to trading book for FRTB-SBA Capital calculation requirements, and their association with metadata of those RFs. For example, Sector Industry, Rating, Investment Grade, CCY, Tenor, Market Cap, Indices etc. To calculate risk charge under SBA, banks need to compute three levels of factors sensitivities matrix per risk factors for each risk class.

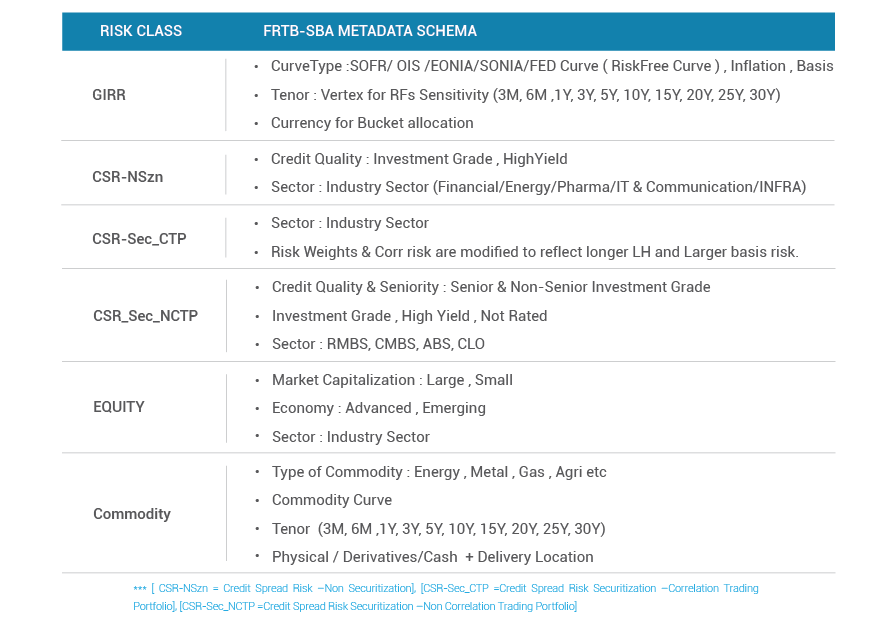

Banks and Financial Institutions need to create a risk data taxonomy for attributing right set of RFs for a trade FRTB-SBA Capital compliant. The RFs should reflect the FRTB regulatory guidelines and should be in sync with the FO pricing model and official PnL Calculation model. These RFs would be further used for PnL attribution & FRTB-SBA Capital allocation requirements.

We have worked out an example on metadata association with RFs. This metadata association /attribution is very important for FRTB-SBA Capital calculation and aggregation schema.

For building metadata, Bank can take help from third party vendors like Markit/ Bloomberg/ Reuters/ Golden Sources or internally they can build instruments level static data and reference data for metadata mapping with trading book risk factors exposure.

3. FRTB-SBA Calculation Gap

The modified risk charge calculation methodology under SBA as per FRTB has necessitated an understanding of the gaps in data requirement between the existing models and calculators versus those required under the new rules.

Let’s take an example of 5Yx10Y USD LIBOR6M Rate Swaption trade to understand the complexity of FRTB-SBA Calculation and Data Challenges:

There are two broad risk factors [RFs] with this trade

1. USD LIBOR6M Yield Curve with Term structure [3M,6M,1Y,3Y,5Y,10Y]

2. USD Vol Curve with Three level of Moneyness [ATM, ITM, OTM], Option Maturity 5Y and Underlying Tenor 10Y.

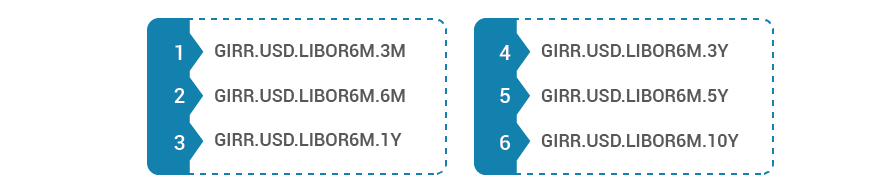

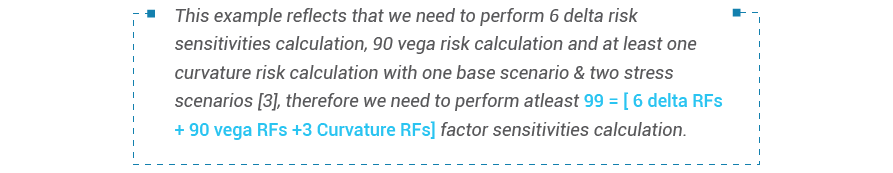

There are six risk factors attached with USD LIBOR6M Yield Curve that is Interest rate [GIRR] as risk class:

The USD Vol Curve risk factor dimension would be 3D

The Total RFs required to perform vega capital charge calculation would be = 3 Moneyness x 6 underlying Tenor x 5 Option Maturity = 90 RFs

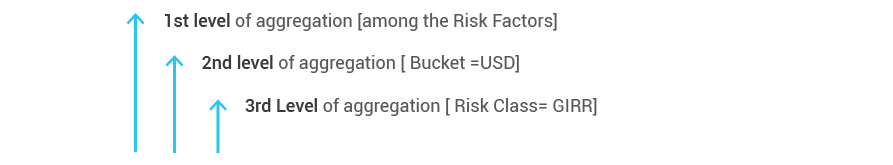

These risks emanating from 5Yx10Y USD LIBOR6M Rate Swaption trade need to aggregated into three level aggregation hierarchy.

Now assume that we have 1000 trades in our trading booking portfolio for a small /medium sized bank with different attributes

The calculation and data requirements would grow in exponential/linear fashion for FRTB-SBA capital charge for the given trading desk/portfolio.

Calculations per trade by Banks/FI may jump up significantly from the existing 250 to 500 calculations under Basel 2.5 regulations to a massive 12,000 calculations under the FRTB-SBA capital calculation due to the new prescribed risk factors and liquidity computation. This is due to the estimation of at least 79 different calculation inputs required under FRTB-SBA for each factor sensitivity class, excluding FX Risk and GIRR, assuming the trading book has assets across buckets.

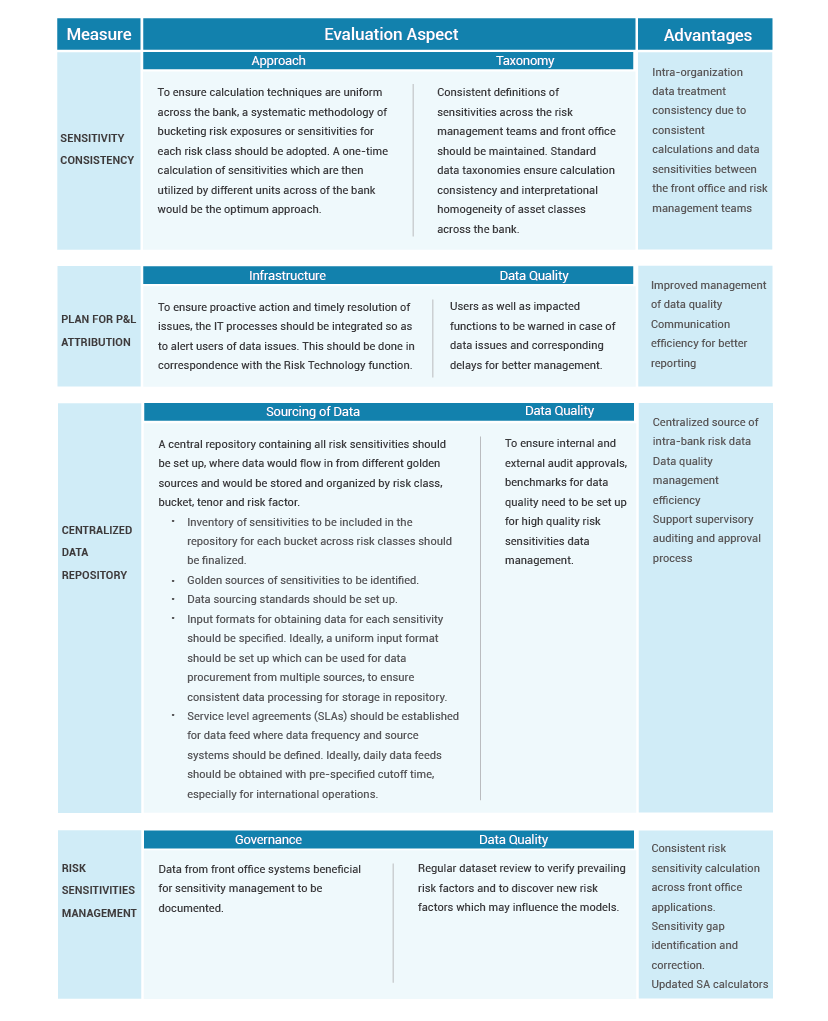

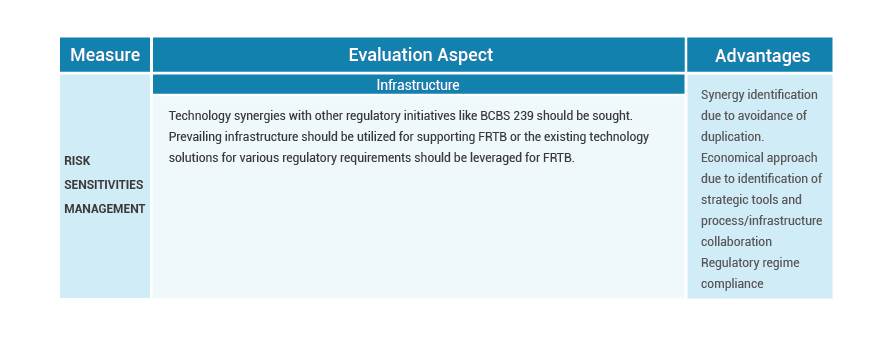

A successful implementation of FRTB SBA rules merits effective data sourcing and management framework. The following measures provide recommendations which the banks can adopt for improvement in their data strategies and to harmonize them with the FRTB SBA rules -

Conclusion

Don't miss this roundup of our newest and most distinctive insights

Subscribe to our insights to get them delivered directly to your inbox