1. Introduction

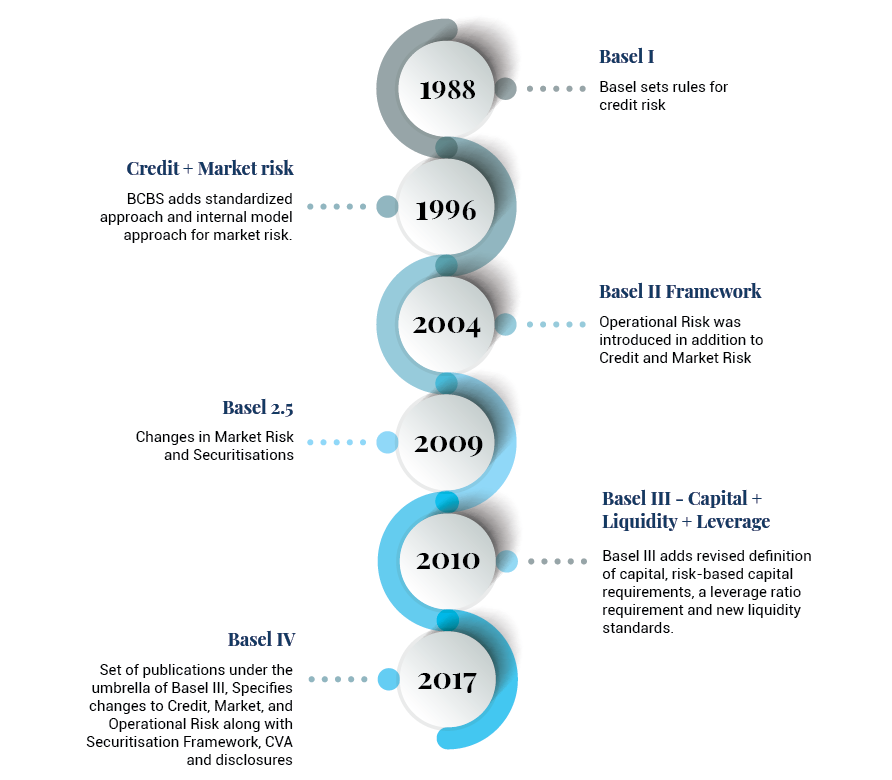

The Basel Committee on Banking Supervision (BCBS) is the primary global standard-setter for the prudential regulation of banks. BCBS introduced the first capital accord in 1988, which has since then been evolved into an integrated Basel Framework comprising of all the current and forthcoming standards of BCBS.

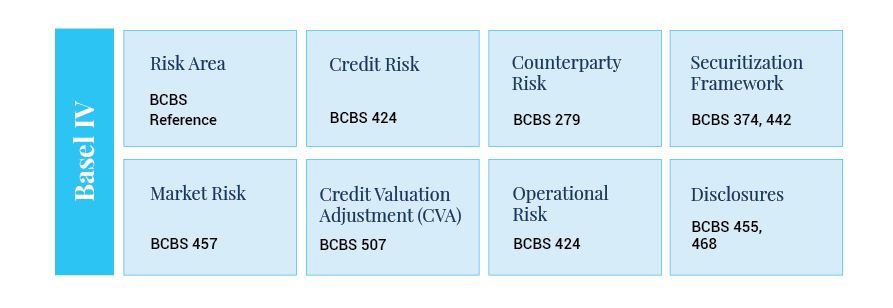

Officially, there have been three capital accords, viz. Basel I, Basel II, and Basel III. These accords are primarily focused on governing capital adequacy i.e. the ratio of regulatory capital to risk-weighted assets of the banks. Under the umbrella of Basel III, a set of publications were introduced around 2017, which mainly focused on changing the denominator of capital adequacy i.e., the method of calculation of risk weights for all types of risks and came to be known as Basel IV by the banking industry in general. The publications under Basel IV have been mentioned below.

2. Basel IV- Salient Points

Basel IV aims at restoring credibility in the calculation of risk-weighted assets (RWAs) and improving the comparability of banks’ capital ratios by:

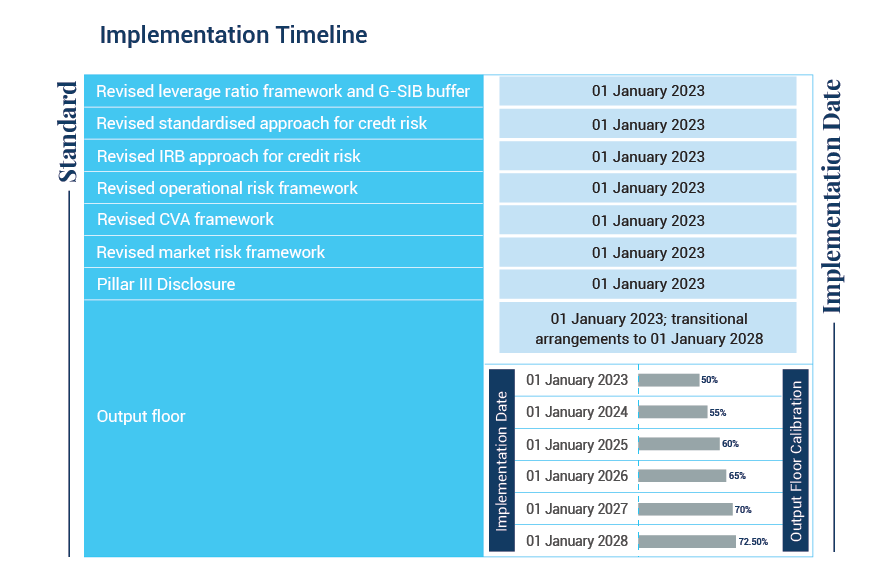

The banks are expected to adopt the revised Basel IV standards by 1st January 2023. The phase-in of Output Floor requirements will also start on 1st January 2023, which will continue till 1st January 2028.

The Basel IV regulations have introduced significant changes in the way risk weights are calculated. The changes range from the recalibration of existing standardized approaches for credit risk to the replacement of all existing approaches with a new standardized approach for operational risk.

One of the most important changes is the imposition of standardized models for calculating risk-weighted assets (RWAs) and constraining the use of internal ratings-based (IRB) models. Additionally, as per the new rules, the banks’ RWA calculations for Pillar 1 capital requirements generated through the use of internal models cannot fall below 72.5 percent of the RWAs calculated under the standardized approach. Whenever the capital requirements as per internal models lead to a lower number, the bank must still allocate capital no less than 72.5 percent of the capital requirements as per the standardized approach. This section covers the major changes introduced by Basel IV.

3. Basel IV- Implications

The aim of Basel recommendations since inception has been to strengthen the banks’ resilience to crises. Adding on the foundation laid by previous iterations of Basel recommendations, Basel IV will ensure a safer and better-capitalized banking system by introducing significant changes in the capital computation approaches. These changes will have a range of implications for banks depending on the business model/product offerings, geographies, and existing capital computation approaches used by the banks.

Major implications for the banks have been listed below:

1. Credit Risk SA and IRB Approach

Capital computation framework to undergo a significant update

2. Counterparty Credit Risk

Capital computation framework to be update

3. Market Risk

System capabilities need to be enhanced

4. Operational Risk

Capital Computation framework to be updated

5. Output floor

Capital Computation framework to be updated

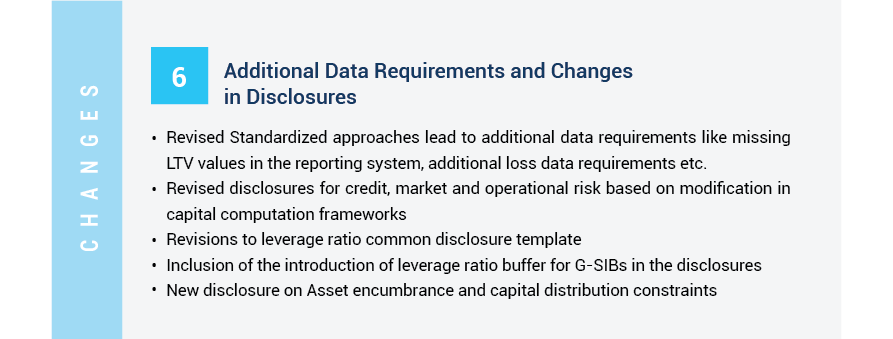

6. Reporting and analytical capabilities to be enhanced

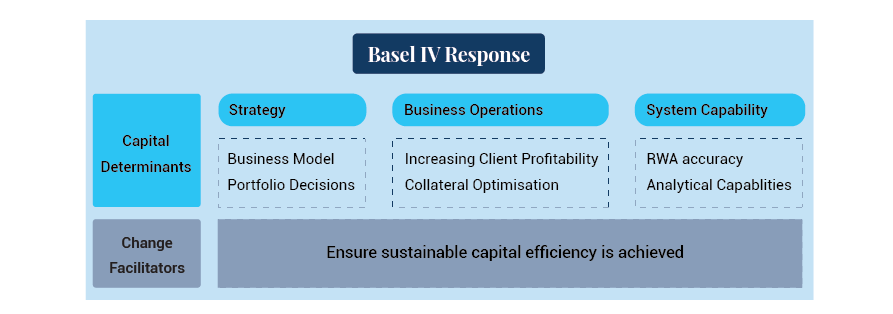

The repercussions will vary for individual banks depending on the geography and business model and each bank will need its own customized response plan. Regardless, the banks can start with a few likely response measures to manage the expectations of investors and rating agencies. This section describes a two-part response to the new Basel norms, which would help the Banks in optimizing the capital requirements while addressing the changes.

The first part of the response focuses on the capital determinants and thus, aims at streamlining Strategy & Vision, Business Operations, and System Capability. The second part of the response focuses on managing the capital determinants using change facilitators consisting of a robust control framework, updated capital management strategy, training programs to inculcate awareness at all levels in the bank and investing in sustainable IT solutions.

Capital Determinants

Capital determinants help in increasing capital efficiency by adjusting the business model to new requirements, increasing risk-based profitability, and improving RWA accuracy. The capital determinants have been covered below:

Strategy

Business Operations

System Capability

Change Facilitators

Change facilitators provide a conducive environment for ensuring that the capital efficiency being brought by above measures is sustainable. The following steps can be undertaken to ensure that actions to improve capital efficiency become a part of the bank’s culture and infrastructure:

At an overall level, Basel IV introduces a host of changes, which have the potential to significantly affect the banks’ capital requirements. In order to optimize the impact on capital and ensure compliance with the expected timelines, banks should invest the requisite time and resources to adopt the response measures. Each bank has its unique perspective about strategy, capital management, control frameworks, IT solutions, etc., and the individual response should be customized based on the bank’s sensitivity to Basel IV changes.

Don't miss this roundup of our newest and most distinctive insights

Subscribe to our insights to get them delivered directly to your inbox