1. Introduction

Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. This definition includes legal risk but excludes strategic and reputational risk.

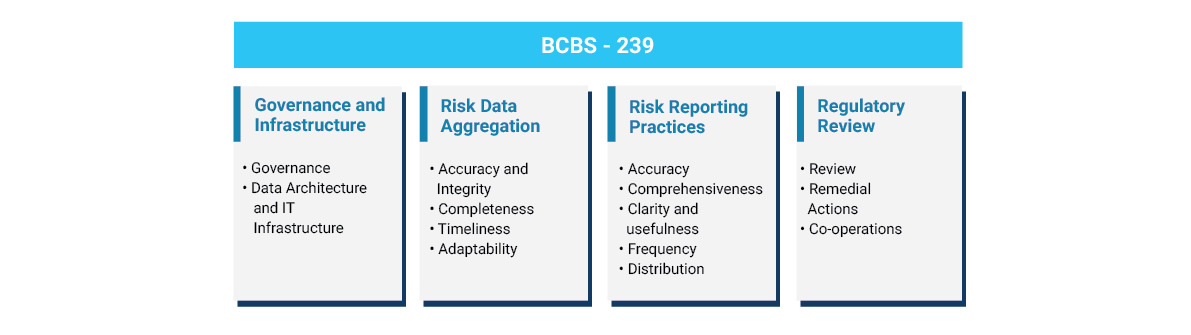

The Basel Committee on Banking Supervision (BCBS) released the final set of rules on operational risk capital in December 2017 for streamlining the operational risk management framework. All existing Basel II approaches for measuring minimum operational risk capital requirements are replaced with a single risk-sensitive standardised approach to be used by all banks.

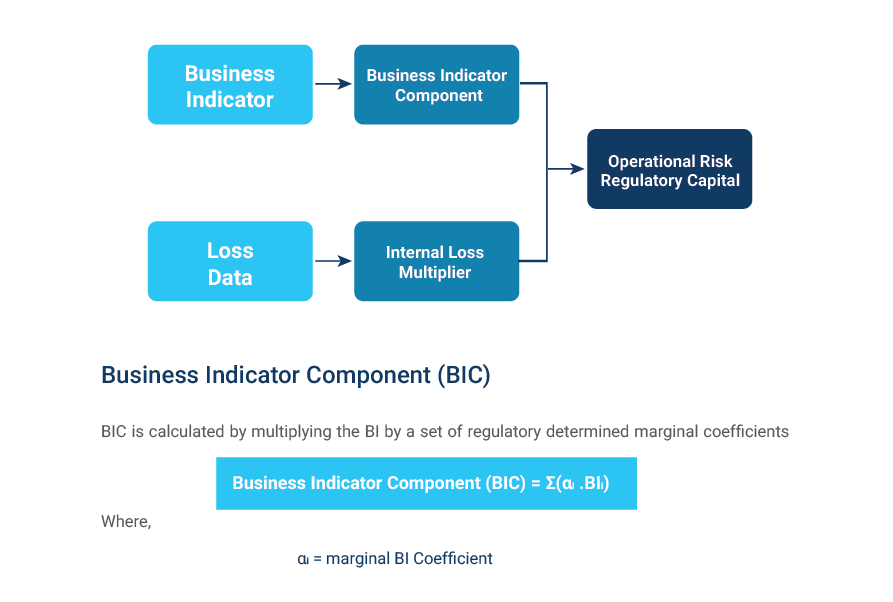

The new standardised approach for operational risk determines a bank’s operational risk capital requirements based on two components:

The approach assumes that operational risk increases at an increasing rate with business indicators and that the banks which have experienced greater operational risk losses historically have a higher likelihood of experiencing operational risk losses in the future.

The implementation date for the revised operational risk framework is 1st January 2023

1. Why introduce a new approach

The three broad approaches which have been used for the calculation of operational risk capital charge are the Basic Indicator Approach (BIA), the Standardised Approach (TSA)/ Alternative Standardised Approach (ASA), and the Advanced Measurement Approach (AMA).

BIA and TSA/ASA offer simplicity and comparability in capital computation. While both BIA and TSA/ASA use Gross Income as a proxy for operational risk exposure, TSA requires Gross Income to be measured separately for each business line. Flagging of income based on Basel business lines makes TSA relatively difficult to implement in comparison to BIA.

The common missing link in BIA and TSA/ASA in comparison to AMA is the lack of risk sensitivity based on loss experience of the banks. AMA allows for the estimation of regulatory capital based on a diverse range of internal modelling practices subject to supervisory approval.

The AMA’s principles-based framework was established with a significant degree of flexibility which was expected to considerably taper down over time. However, the inherent complexity of the AMA and the lack of comparability arising from a wide range of internal modelling practices accentuated variability in risk-weighted asset calculations, which in turn lowered the confidence in risk-weighted capital ratios.

The Basel Committee introduced the new Standardised Approach (SA) in order to lay focus on the simplicity and comparability of capital requirements offered by BIA and TSA/ASA while incorporating the risk sensitivity of AMA in the form of internal loss experience.

2. Standardised Approach

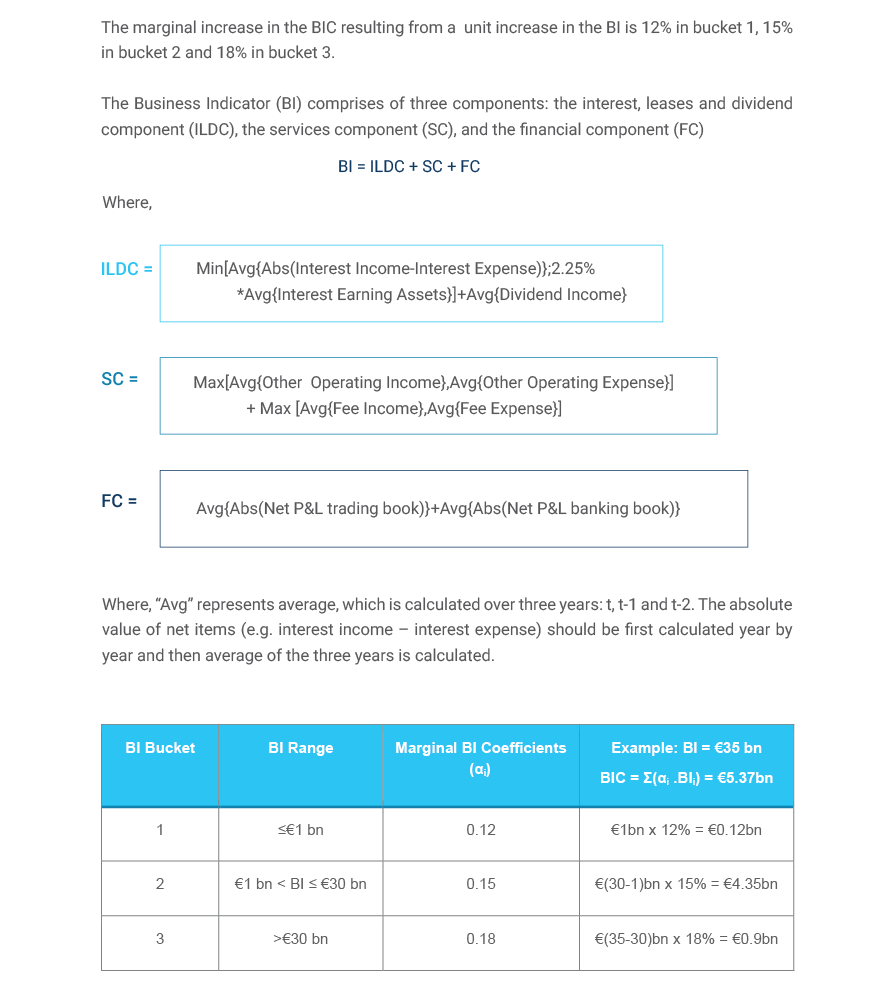

The capital computation methodology of the standardised approach is based on the following components:

2. High-Quality Data Requirements

The loss data component required for the calculation of ILM has to be based on 10 years of high-quality loss data. The loss data standards include the following requirements:

ILM Decision Tree

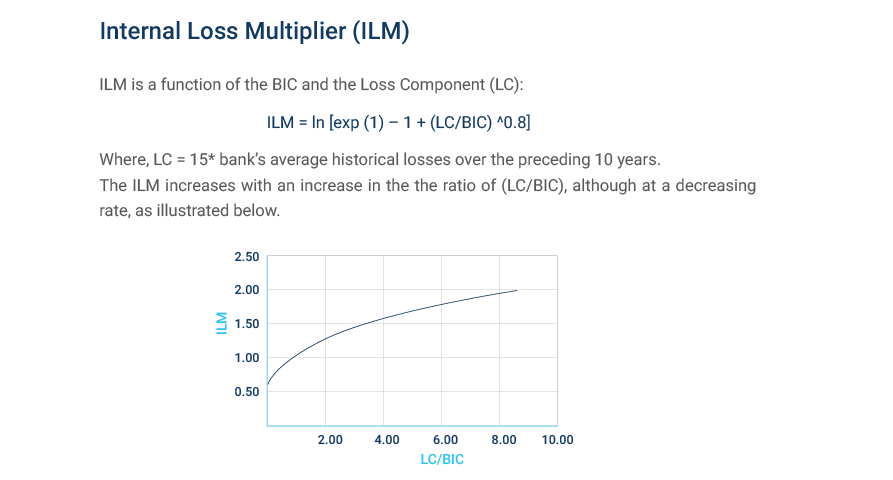

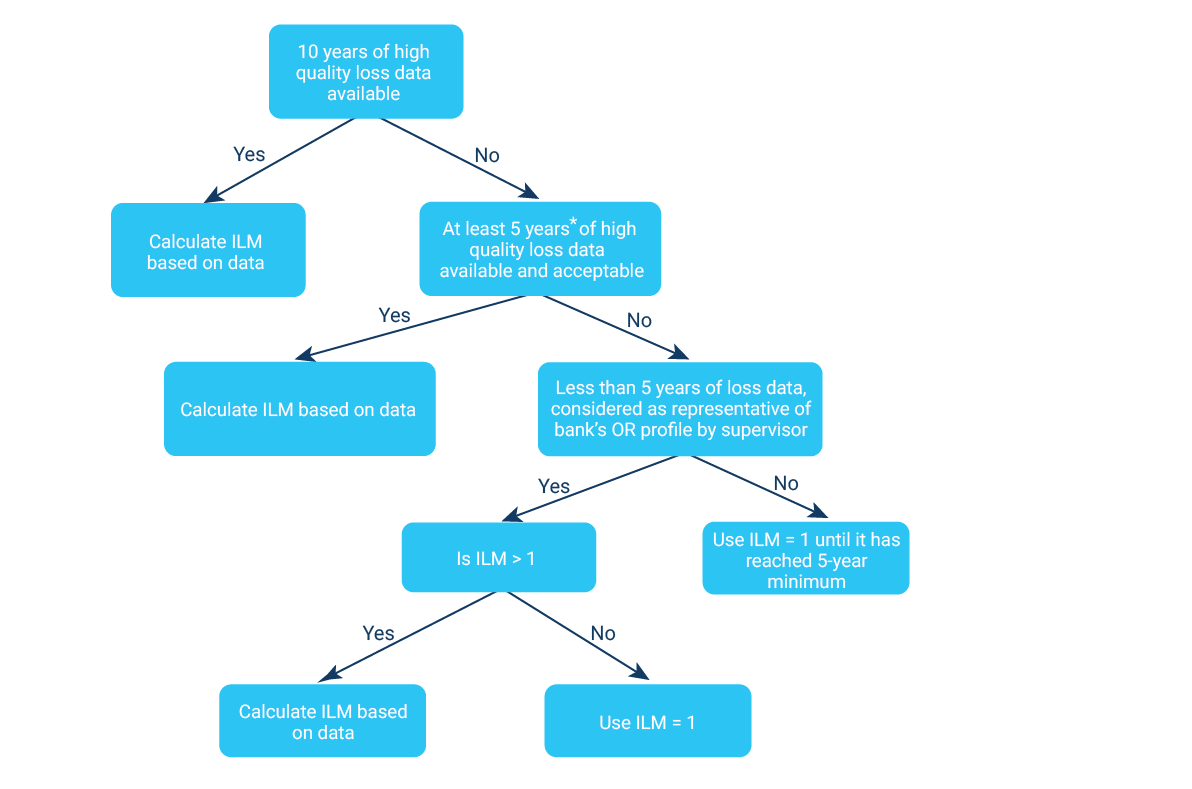

The ILM is a function of Business Indicator Component (BIC) and Loss Component (LC) where the LC must be based on 10 years of high-quality annual loss data.

As a part of the transition, in case a bank does not have 10 years of high-quality loss data, a minimum of five years of loss data may be used. However, in case of a lack of five years of high-quality loss data, capital may solely be calculated on BIC. The supervisors may ask a bank to calculate capital requirements using fewer than five years of losses when supervisors believe that the losses are representative of the bank’s operational risk exposure and the ILM is greater than 1

Supervisory Discretion

The new standardised approach provides a lot of discretion to the national supervisors. Supervisory discretions in context to ILM are listed below.

Setting ILM as 1 at national discretion

Supervisors have the discretion to set ILM as one for all the banks in their jurisdiction, at national discretion (banks would still be subject to the full set of Pillar 3 disclosure requirements)

Use of ILM for Banks in Bucket 1

ILM for banks whose total BI is within the first bucket is assumed as 1. The national supervisors may however, allow usage of internal loss data while calculating capital requirements for these banks, given that the loss data collection requirements are met by such banks

ILM in case of less than 5 years data

Supervisors may require banks to calculate capital requirements using fewer than five years of losses if the ILM is greater than 1 and supervisors believe the losses are representative of the operational risk exposure of the banks

Loss Data Exclusion

Banks may seek supervisory approval for excluding certain operational loss events from capital computation which are no longer relevant to the risk profile of banks

Minimum threshold for loss data collection

At national discretion, the minimum loss data threshold of €20,000 for inclusion of loss data in capital computation set could be increased to €100,000

3. Loss Data Capture in Banks

The new standardised approach has a 10 year high quality loss data requirement for including ILM in capital calculation. The SA requires high standard loss data to be identified, collected, treated and maintained. Currently, the banks are in different phases of building internal loss data repository subject to the following regulatory requirements:

As of now, the banks on advanced approaches are likely to be able to fulfill the high quality loss data requirement.

However, the banks on less advanced approaches may have to substantially increase the coverage and depth of internal loss data reporting.

4. Implication for Banks

System and Procedures

AMA, TSA and ASA banks are currently required to collect operational losses and, in many jurisdictions, they are also required to report these losses to supervisors. Impact on the banks as per their current capital computation approach is provided below -

Capital Requirements

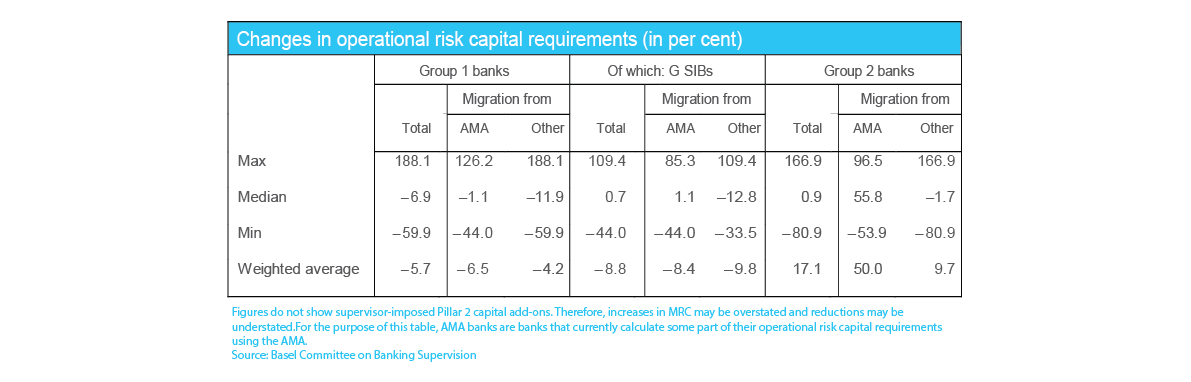

BCBS monitors the effects of Basel III reforms by assessing the impact on capital requirement of the banks through a Quantitative Impact Study (QIS). The QIS evaluates the changes in operational risk Minimum Required Capital (MRC) to arrive at the impact against the existing framework.

The sample size for the overall impact analysis consisted of 82 Group 1 or large banks (among them 30 G-SIBs) and 31 Group 2 or small banks.

Strategic Decisions

The marginal increase in BIC due to an increase in BI is different across the buckets i.e., larger banks will face much higher capital charges as compared to smaller ones. Additionally, the overall capital requirement for the banks with similar BI components differs based on the LDC. This lays stress on the consideration of the capital implications and effectiveness of risk management systems as an essential part of any strategic decision related to business growth.

Risk Control Framework

Traditionally, the focus of operational loss event reporting has been on high severity losses. Also, the general stance on the smaller losses has been to accept them as cost of doing business.

The ILM component introduced by the new standardised approach takes into account the average of all historical losses over the preceding 10 years. Further, all losses from past operational risk events are going to be considered equal in the loss multiplier, regardless of the individual loss amount. This means that high frequency and low impact operational losses will require equal consideration from the management and in the overall risk control framework.

5. Shortcomings of SA

Backward Looking

AMA incentivised banks to make more forward-looking provision for operational risk losses by taking into account the changes in their business environment and internal control functions. However, the new standardised approach takes average historical losses into account which may not be as relevant in accounting for the emerging risks. Losing focus on emerging risks, combined with the fact that banks may no longer employ scenario analysis as an ORM tool, may lead to a situation where the overall quality of operational risk management is deteriorated.

Long Loss Data Window

The loss data collection window of 10 years is bound to penalize the lenders for operational risk incidents dating back up to a decade. And since all risks throughout the loss data window are given equal weight in the new standardised approach, the repercussions on capital requirement due to an operational risk incident occurring today would at least continue for a decade.

Overstated Comparability

The framework was designed keeping in view the comparability of capital computation approaches across banks and jurisdictions. However, ILM is subject to a lot of supervisory discretions including the discretion to not consider ILM component in capital computation. This attaches a lot of caveats to the initial aim of comparable OR capital across the banks.

6. Next Step

Banks will now have to create a repository of high quality risk data as per the requirement of the new standardised approach. This data can be utilized by the banks, not just for the capital computation, but also for enhancing their risk analytics.

Banks have been interested in developing and strengthening their risk analytics. This interest however, has been confined by the lack of availability of useful data. The risk data collection will steer the banks to be in a position to make use of advanced techniques like pattern analysis and predictive risk intelligence which could help the banks in identifying the high risk areas and reducing potential losses from materializing.

Operational Risk Management techniques like Root Cause Analysis (RCA) are bound to get more streamlined with improved data analytics capabilities. RCA, a long standing trend in operational risk reporting, involves deep diving into the cause of operational problems and aims at subsequently leading to better risk-control structure. As of now some common aids used for RCA include histograms, pareto charts, relations diagrams etc. However these techniques are mostly used in silo, which decreases the effectiveness of RCA. A vast influx of data and relations combined with pattern recognition or predictive analysis will enable the banks to actually making use of the lessons learnt from an incident.

Given the advanced tools and data analytics available today, banks should capitalize on the loss data and make use of machine learning and artificial intelligence techniques to incorporate a forward looking element in the operational risk management. Further, this can be seen as an opportunity to enhance the early warning indicator framework with respect to operational risk incidents. In order to fully reap the benefits of predictive data analytics, it may be worthwhile for the banks to capture even more data points than specified by the regulatory guidelines.

Don't miss this roundup of our newest and most distinctive insights

Subscribe to our insights to get them delivered directly to your inbox